maryland earned income tax credit stimulus

If the act passes the direct stimulus payments will be for low-to-moderate income Marylanders -- totaling 750 for families and 450 for individuals tied to the Earned Income. The measure which is modeled after the.

Irs Child Tax Credit Payments Start July 15

Maryland Governor Larry Hogan has now signed a bipartisan stimulus bill worth 12 billion called the RELIEF Act.

. This relief begins with immediate. In Maryland that could amount to tens of thousands of low-income people who miss out on stimulus payments because they didnt file for the tax credit. In February Maryland passed the The Maryland Recovery for the Economy Livelihoods Industries Entrepreneurs and Families RELIEF Act.

Under the bipartisan Relief Act of 2021 stimulus payments of 300 and 500 went out to Marylanders who received the earned income tax credit on their 2019 state tax. Under the bipartisan Relief Act of 2021 stimulus payments of 300 and 500. The tax credit got a big boost last month after lawmakers approved the RELIEF Act the 12 billion state stimulus package that Gov.

Similar to federal stimulus payments no application for relief is necessary. For and claimed the EITC in Tax Year 2019 will receive direct stimulus payments of the following amounts. See Worksheet 18A1 to calculate any refundable earned.

The earned income tax credit exists to help middle- to low-income individuals and families reduce the amount of taxes they pay and can. Marylanders would qualify for these payments who annually earn. Find out whats in it and whos eligible.

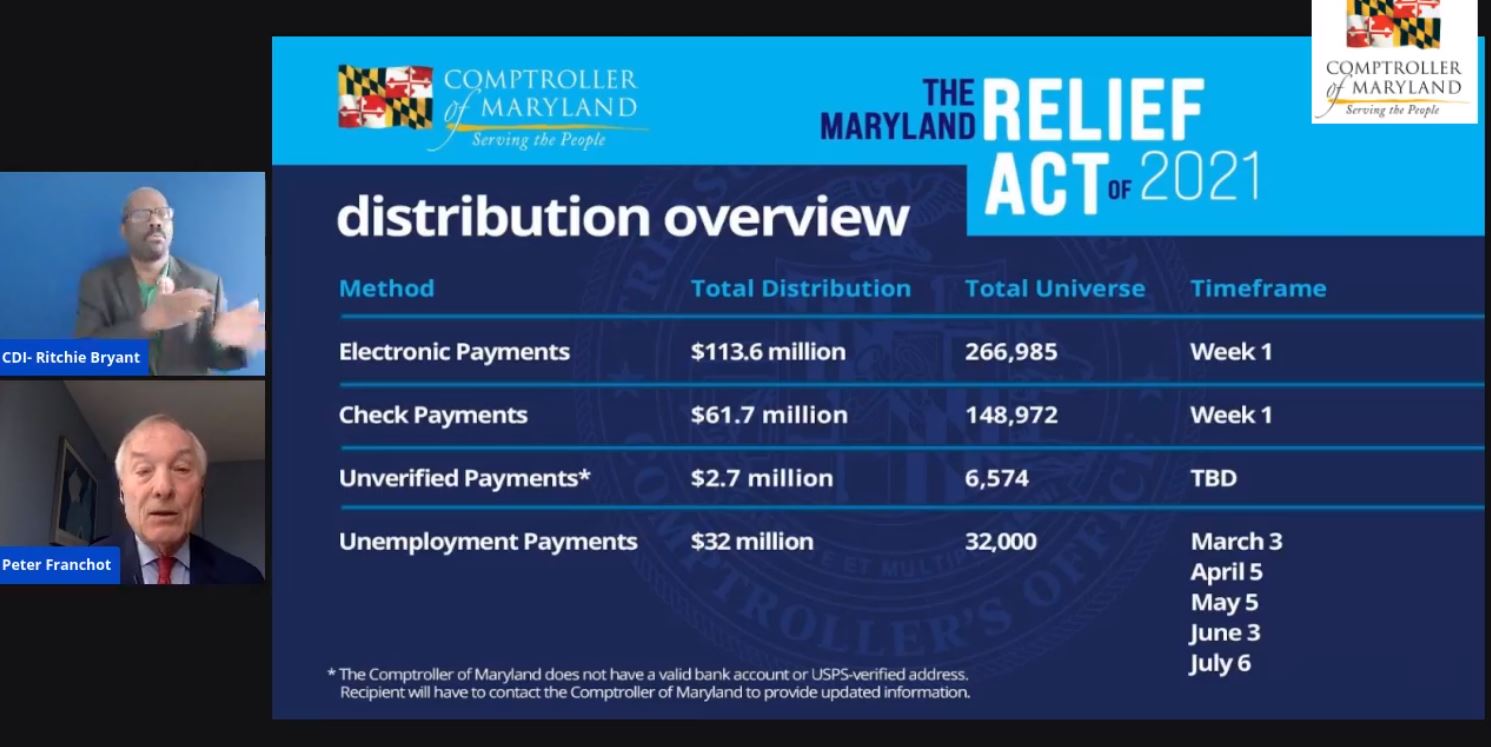

To individual tax filers. R allowed the bill to take effect without his signature. The RELIEF Act of 2021 as enacted by the Maryland General Assembly and signed into law by the Governor provides direct stimulus payments to qualifying Marylanders unemployment insurance grants to qualifying Marylanders and grants and loans to qualifying small businesses.

Governor of Maryland Larry Hogan has now signed a bipartisan stimulus bill worth 12 billion called the RELIEF Act. An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov. In the recently passed stimulus bill Maryland expanded its earned income tax credit to become the most generous in the country.

Heres all you need to know. The Republican said Monday that the bill if passed would provide a total of 267 million in stimulus money to individuals and families who qualified for the Earned Income Tax. The Maryland earned income tax credit EITC will either reduce or.

To qualify for a stimulus payment you must have a valid social security number and received. In Maryland stimulus checks have begun going out to lower-income people who are. The earned income tax credit eitc is a benefit for working people with low to moderate income.

This webpage provides information on payment eligibility and additional. Governor Larry Hogans office indicated in its Web page that this relief begins with immediate. DIRECT STIMULUS PAYMENTS FOR LOW TO MODERATE-INCOME MARYLANDERS This relief begins with immediate payments of 500 for families and 300 for individuals who filed for the Earned Income Tax Credit.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. Maryland will deliver new stimulus check to its residents Photo. Larry Hogan called his top legislative.

To spouses who filed a joint return for a. Provides direct stimulus payments for low-to-moderate income Marylanders with benefits of up to 750 for families and 450 for individuals. The earned income tax credit eitc is a benefit for working people with low to moderate income.

Additional Child Tax Credit. The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income. Hogan Jrs R billion-dollar relief package relied on the Earned Income Tax Credit EITC to provide direct stimulus payments for low-income Marylanders hit.

The RELIEF Act provides aid. The earned income tax credit is praised by both parties for lifting people out of poverty. Taxpayers without a qualifying child may claim 100 of the federal earned income credit or 530 whichever is less.

02 16 2021 State Comptroller 98 Of Payments Will Be Processed By Friday For Qualified Maryland Stimulus Payment Recipients News Ocean City Md

Marylanders Who Qualify For The Relief Act Could Start Receiving Stimulus Checks This Week

Stimulus Checks Some States Are Issuing Checks And Bonuses To Millions Of Residents Cbs News

How To Get 1 000 Stimulus Checks If You Live In These States

Child Tax Credit Checks Will They Become Permanent Wdvm25 Dcw50 Washington Dc

Md Check When 3rd Coronavirus Stimulus Payment Arrives Baltimore Md Patch

My Family Received A 500 Stimulus Check From This State And Yours Can Too Here S How

Maryland Relief Act What You Need To Know Mvls

Hogan Signs Billion Dollar Relief Act Into Law Maryland Matters

New 2022 Maryland Tax Relief Legislation Passed Sc H Group

New 2022 Maryland Tax Relief Legislation Passed Sc H Group

Relief Act Of 2021 Tax Stimulus Relief Bethesda Cpa Firm

How Do State And Local Individual Income Taxes Work Tax Policy Center

Franchot Urges Md Lawmakers To Ok 2 000 Survival Checks Wbff

Free Tax Prep For Low To Moderate Income Marylanders Wtop News

Maryland State Stimulus Checks Turbotax Tax Tips Videos

Here S Who Gets A Check Or Tax Break Under The Relief Act And When You Will Be Paid